How-to: every deal-post contains availability, and link-button where ticket is searchable. Some deals have limited availability. For you convenience we may generate direct links or dates combinations. Information is valid at time of publication. So sometimes you may not find the price mentioned in the post (ex. after several days of the original posting date). It means that the deal was sold out or supplier (airline/agency) has changed the conditions or removed the offer.

Disclaimer: AirfareSpot.com gets commission for some links on the blog. You don’t have to use our links, but we’re very grateful when you do click them. Please view our advertiser policy page for more information.

Here we will try to discuss how can we meet minimum spending requirements on credit card in order to faster receive our sign-up bonus. Of course, without breaking budget, since credit card is just and extra help to make our lives more happy and entertained.

First of all, use credit whenever and whatever it is possible.

Here is the list with all possible variants to use credit card.

- Dining.

- Gas.

- Bills/utilities. http://www.evolvemoney.com

- Insurance.

- Medical payments

- Groceries

- Gift Cards. Note: Some credit card companies, like Citi, will charge gift card purchases as cash advances. Always do a test and research.

- Memberships

- Mortgage payment. https://www.chargesmart.com

- Electronic payment services.

- Rent. http://www.williampaid.com 2.95% of total payment

- Car payments/registration. https://www.chargesmart.com

- College tuition. https://www.officialpayments.com

- Student loans. https://www.chargesmart.com http://www.evolvemoney.com

- Taxes. Check the IRS list of tax payment service providers.

- Money Transfers

- Paypal. Just link credit card to your account.

- Charity.

- Car rent.

- Online shopping.

Convenience Fee To Use Your Credit Card

Sometimes you may notice that companies charge additional fee for using credit card instead of debit. And it can be as low as 1%. But think of that on different side.

For example, I need to meet $3000 minimum spending in order to receive 40000 bonus miles. 1% of $3000 – $30. So,paying $30 for 40000 bonus miles is not that bad at all. Just always check conditions and do some math.

ALWAYS! check terms and conditions, as some services do charge fees as a convenience to use credit card. And NEVER spend for miles. Use the common sense.

Disclaimer: AirfareSpot.com gets commission for some links on the blog. You don’t have to use our links, but we’re very grateful when you do click them. Please view our advertiser policy page for more information.

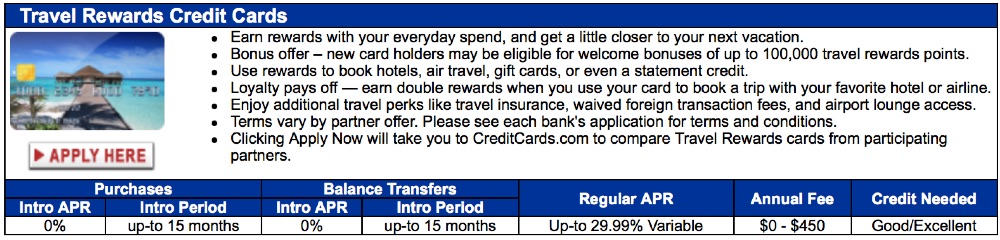

You can check, which cards allow adding authorized user and which cards give high bonuses right now by clicking on the banner below.

Image Credits:Sean MacEntee (flickr) used under CC BY 2.0 license / Resized from original.